Which Answer Choice Best Describes the Idea of Crowding-out

Which of the following best describes bartleby. A decreasing budge deficits increase interest rates and decrease private investment spending.

Objective Iii Set Ppt Download

Expenditure-based fiscal policy leads to more.

. Imports replace domestic production. Which statement best describes the monetarist fiscal policy prescription for a recession. The theory behind the crowding out effect assumes that governmental borrowing uses up a larger and larger proportion of the total supply of savings available for investment.

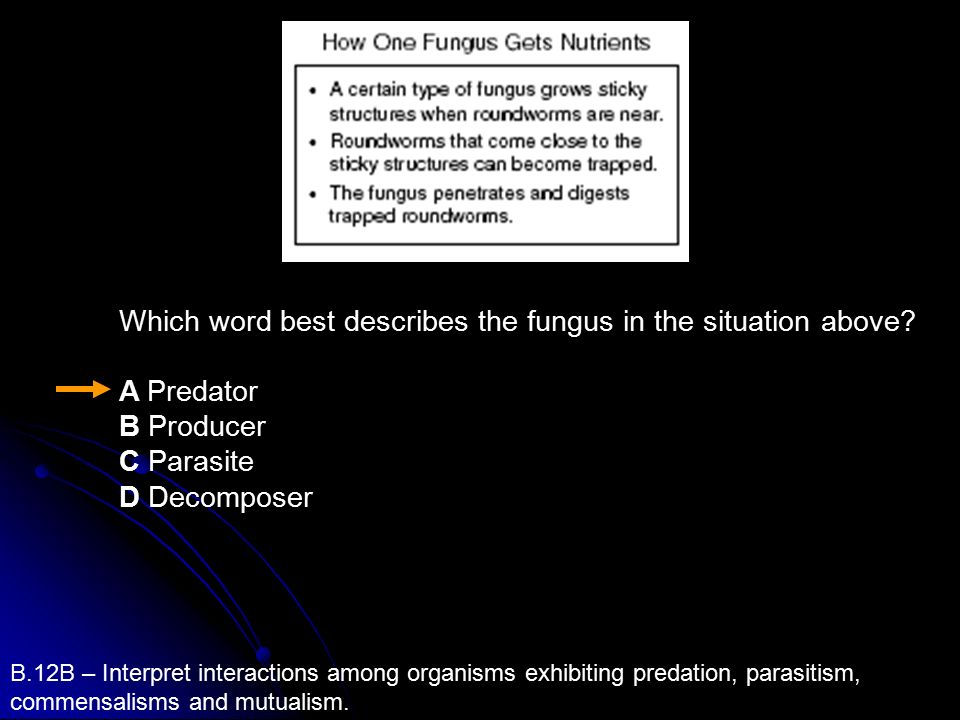

A no change in domestic output or the price level. The statement that best describes a stage in the crowding-out effect is The government issues treasury bonds and spends the revenue on a new highway system. The increase in G was designed to increase AD but the resulting increase in interest rates may decrease I.

The demand for loanable funds will decrease driving interest rates down. Thus the impact of the expansionary fiscal policy may be reduced. Defining key concepts - ensure that you can accurately define main phrases such as crowding out.

It accounts for less than 1 percent of government revenue. B both the domestic output and the price level to rise. C the crowding-out effect.

The economy will self-adjust d. The demand for loanable funds will increase driving interest rates up. Crowding out begins to take effect when the interest rate level reaches a.

Printing money causes the nominal interest rate to decrease. The loss of funds for private investments due to government borrowing. Which statement best describes the Keynesian monetary policy prescription for a recession.

Sometimes government adopts an expansionary fiscal policy stance and increases its spending to boost the economic activityThis leads to an increase in interest rates. Aaron could have a comparative advantage in producing both milk and cheese. A situation when increased interest rates lead to a reduction in private investment spending such that it dampens the initial increase of.

Expenditure-based fiscal policy raises inflation expectations and interest rates causing private sector C. Reductions in the Federal debt. This worksheet and quiz will let you practice the following skills.

It accounts for 10 percent of government revenue. Saving increases at the expense of investment. The crowding-out effect of expansionary fiscal policy suggests that A.

An increase in borrowing by the government will push interest rates upward which will lead to a. The crowding-out effect is the reduction in investment spending caused by the increase in interest rates arising from an increase in government spending financed by borrowing. A situation when increased interest rates lead to a reduction in private investment spending such that it dampens the initial increase of total investment spending is called crowding out effect.

The CROWDING OUT EFFECT of expansionary fiscal policy suggests that governament spending increases at the expense of private investment increases in government spending financed through borrowing will increase the interest rate and thereby reduce investment. D the net export effect. Because demand for savings increases while supply stays the same the price of money the interest rate goes up.

Which of the following statements best describes the monetarist views of crowding-out. The inability of the government to borrow as much as it needs because of investment spending. Expenditure-based fiscal policy requires the collection of additional taxes which reduce household incomes and O B.

O An increase in government expenditures will cause taxes to rise which will reduce both aggregate demand and output. In economics crowding out is a phenomenon that occurs when increased government involvement in a sector of the market economy substantially affects the remainder of the market either on the supply or demand side of the market. According to the crowding-out effect if the federal government borrows to finance deficit spending a.

The correct answer is C The government issues treasury bonds and spends the revenue on a new highway system. One type frequently discussed is when expansionary fiscal policy reduces investment spending by the private sector. 14 Why will there be less crowding out of government spending by private spending the less sensitive consumption investment and net exports are to changes in interest rates.

If V is stable fiscal policy does not matter Increase government spending andor decrease taxes Do nothing. The table shows the units of steel and personal computers a worker can produce per month in Germany and South Korea. The crowding out effect refers to a.

Use this table to answer the question. The economic term the crowding-out effect can be understood as the moment when. Printing money imposes a tax on net borrowers.

Higher interest rates reducing or crowding out consumer borrowing. Government spending increases at the expense of private investment. Which of the following best describes the crowding-out effect.

Which answer choice best describes the idea of crowding-out. The crowding out effect is an economic theory arguing that rising public sector spending drives down or even eliminates private sector spending. Which statement best describes the effect of printing money to finance government expenditures on the Canadian economy.

Tons of steel Personal computers PCs Germany 40 10 South Korea 16 8. Suppose the economy is operating within the intermediate range of the aggregate supply curve and government increases both expenditures and taxes by 20 billion. Private investment increases at the expense of government spending.

According to the crowding-out effe. Write the word or phrase that best completes each statement or answers the question.

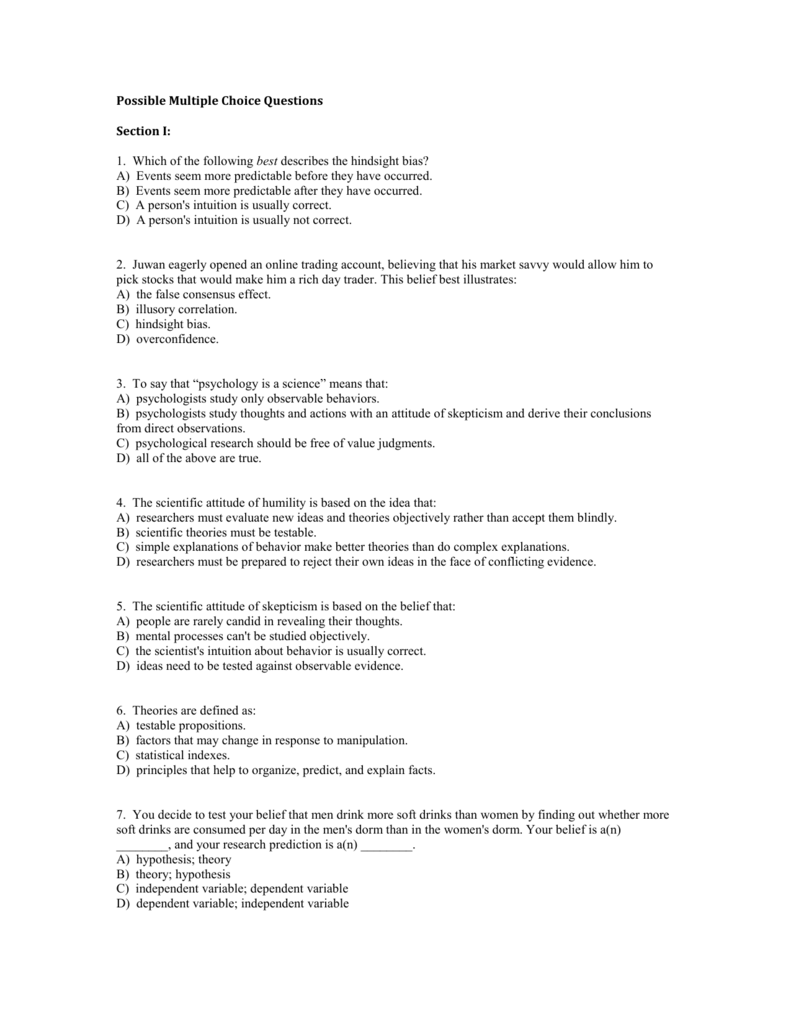

Possible Multiple Choice Questions

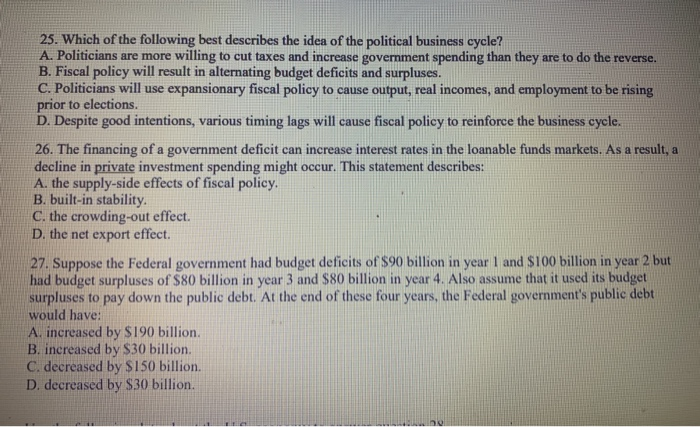

Solved 25 Which Of The Following Best Describes The Idea Of Chegg Com

No comments for "Which Answer Choice Best Describes the Idea of Crowding-out"

Post a Comment